In recent years there has been significant discussion on how additional pipeline capacity was needed to keep pace with Canadian oil production. With production and demand declines in 2020, as well as commitments by the Canadian government on net zero by 2050, is this still true?

Pipeline Capacity

Western Canada produces approximately 95% of Canada’s oil production and there are currently 4 main pipelines that transport crude oil to markets outside of Alberta [1]:

- Enbridge Mainline – delivers from Edmonton, Alberta to markets in U.S. Midwest, Ontario, and Quebec

- Trans Mountain Pipelines – delivers from Edmonton, Alberta to Vancouver, BC, Washington State and offshore markets

- Enbridge Express Pipelines – delivers crude oil from Hardisty Alberta, to Casper, Wyoming

- Keystone Pipeline – delivers from Hardisty Alberta to the U.S. Midwest and Gulf Coast

Other smaller pipeline systems also carry smaller volumes to other U.S. markets. The overall pipeline takeaway capacity of these systems is estimated to be 4.28 MMb/d1. Enbridge and TC Energy are also working to debottleneck their pipeline networks through system optimizations. Within existing infrastructure, an additional 50,000 bbl/day on the original Keystone system, 25,000 bbl/day on the Enbridge Express pipeline, and 50,000 bbl/day on the Enbridge Mainline system are expected to be available by the end of 2021[2].

Additional new capacity has been proposed with the Enbridge Line 3 Replacement and the Trans Mountain Expansion which are currently under construction. U.S. President Joe Biden revoked the Presidential Permit for the Keystone XL and advancement of the project by TC Energy has been suspended as of January 20, 2021 [3].

| Enbridge Line 3 | Trans Mountain Expansion | |

| Announced In-Service Date | 2019 | 2022 |

| Expected date at full capacity | 2021 | 2023 |

| Full Capacity (Mb/d)2 | 370 | 590 |

| Markets Served | U.S. Midwest and Sarnia, Ontario | Vancouver, B.C., Washington State, and Offshore |

All together this is expected to bring western Canada’s available pipeline capacity for export to 5.34 MMb/d by 2023.

Crude Oil Production

The Canadian Energy Regulator recently released its Canada’s Energy Future 2020: Energy Supply and Demand Projects to 2050 (EF2020) report on Canada’s long-term energy outlook. The report looks at all energy commodities across the country, and mainly focuses on two main scenarios based on the level of future action on the reduction of GHG emissions. The Reference Energy System Scenario assumes that action to reduce GHG emissions doesn’t change from what is currently in place. The Evolving Energy System Scenario assumes increasing global action to reduce GHG emission, reducing the demand for fossil fuels and advancements in low carbon technologies that reduce their costs, as well as future Canadian policies in line with current climate change and energy strategies. It is noted that the Evolving Energy Systems Scenario aims to demonstrate progress on GHG emission reductions at similar pace to recent history and does not meet net-zero by 2050 targets which would require acceleration of both policy and technology [4].

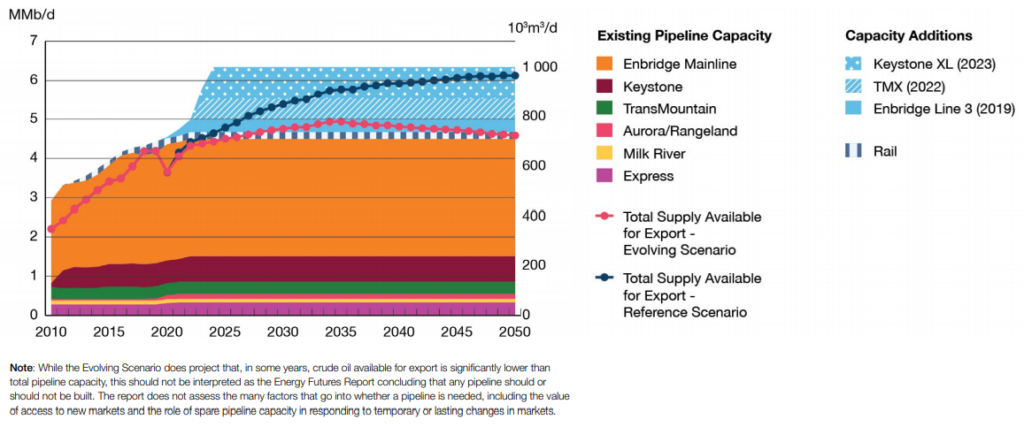

The EF2020 report notes that under the Evolving Scenario crude oil production in Canada is expected to peak at 5.8 MMb/d in 2039 before declining to 5.3 MMb/d in 2050. While conventional oil production is expected to decrease after a recovery in 2021 much of the increase is expected to be from expansions of existing in situ projects [4]. Approximately 600,000 bbl/day is consumed by Western Canadian refineries [5]. Thus, at the anticipated production peak under the Evolving Scenario there will be pipeline export capacity to move the crude oil out of Western Canada to export markets. This is demonstrated in Figure R.12 from the EF2020 report as shown below [4].

Figure R.12 Crude Oil Pipeline Capacity vs. Total Supply Available for Export in the Evolving and Reference Scenarios [4]

What does this mean?

Pipeline critics have pointed to Figure R.12 to demonstrate that additional pipelines are not required under the Evolving Energy scenario. The CER however has noted in the report that it does not come to any conclusions on whether any pipelines should be built, a message reiterated by CER Chief Executive Officer Gitane De Silva in an interview in the Calgary Herald. In the article CER Chief Economist Darren Christie also notes that “Having available capacity in the (pipeline) system is certainly well recognized to be something that helps it work efficiently and provides access to different markets and those sorts of nuances are not things that we dive into in the report [6].”

“While the Evolving Scenario does project that, in some years, crude oil available for export is significantly lower than total pipeline capacity, this should not be interpreted as the Energy Futures Report concluding that any pipeline should or should not be built. The report does not assess the many factors that go into whether a pipeline is needed, including the value of access to new markets and the role of spare pipeline capacity in responding to temporary or lasting changes in markets.”

– Canada’s Energy Future 2020: Energy Supply and Demand Projects to 2050 [4]

So, does Western Canada require additional pipelines if not restricted by pipeline capacity? The answer requires consideration of crude oil markets.

Crude Oil Markets

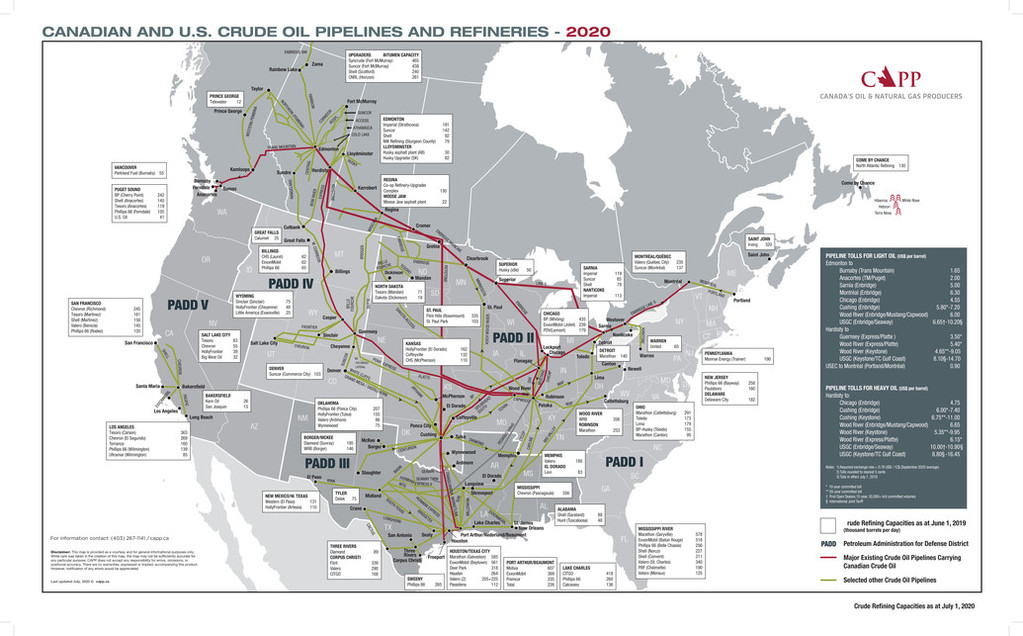

In 2019 Canada exported 3.8 MMb/d of crude oil, of which 98% went to the United States [7]. Canada is the United States’ largest supplier of imported oil [1]. The United States Department of Energy divides the 50 states into 5 market regions called Petroleum Administration of Defense Districts (PADDs) as seen below.

CAPP Canadian and U.S. Crude Oil Pipelines and Refineries – 2020 [8]

Much of Canadian oil imports go to PADD II in the US Midwest, where refineries processed 2.5 MMb/d of Canadian crude in 2019, making up nearly 70% of all refinery feedstocks [9]. This region is served by the Enbridge Mainline system and it is unlikely refineries in this region will have the ability to process additional Canadian heavy crudes. PADD IV in the Rocky Mountains region is served by the Enbridge Express pipeline. With the upcoming expansion to be in-service by the end of 2021 further expansion in the region is not expected due to the low refining capacity of the area. PADD I on the East Coast is isolated from Canadian pipeline supplies as the region relies mostly on offshore crude deliveries from oil tankers. Opportunities for Canadian producers can be found in the US Gulf Coast and West Coast refining hubs.

The US Gulf Coast is one of the largest refining hubs in the world with a refining capacity of about 9 MMb/d, of which 2 MMb/d is heavy crude [9]. It has historically relied on heavy crude oil imports from Venezuela, Mexico, and Columbia, but steep production declines in Venezuela and Mexico have led refineries to look for alternative feedstock suppliers. Canada has looked to expand its share of the market, sending an average of 515,000 b/d to the region during 2019 [10]. The region is served by the Keystone Pipeline, as well as other pipelines from hubs at Cushing, Oklahoma and Patoka, Illinois where the Enbridge Mainline and Express systems can deliver into via US pipelines. It has been difficult for Canadian producers to reach these markets leading to shipping crude by rail, which has higher transport costs, higher emissions, and safety concerns. However even without Keystone XL, Canadian heavy crude oil will still be able to reach the US Gulf Coast. Enbridge has said that once the Line 3 expansion has been completed it will place its Southern Access Pipeline expansion into service, adding additional capacity for Canadian crude into Patoka. The 1.2 MMb/d Capline Pipeline, owned by Marathon Pipe Line LLC and Plains All American Pipeline LP in the US is being reversed in 2021, allowing for heavy crude to be transported from Patoka, Illinois on to St. James, Louisiana [11]. Enbridge has also noted that expansions on the Flanagan South Pipeline and Seaway Pipeline could add an additional 250,000 b/d of capacity to the US Gulf Coast [12]. Additionally, crude oil from the Trans Mountain pipeline system can be loaded on tanker and shipped to the Gulf Coast.

However, the US Gulf Coast may not be the best market for tankers of crude oil shipped from the Trans Mountain pipeline system. PADD V encompasses the US West Coast and includes refineries in California and Washington State. Refineries in Washington are already served by the Trans Mountain Pipeline but there is opportunity for expansion of Canadian crude oil in the California market where it is delivered via tanker ship. Only 10% of PADD V refining feedstock is Canadian crude oil, and most is processed in Washington State. California is the third largest refining hub in the US with a capacity of 2 MMb/d [9]. The refineries in California are able to process extra heavy crude oil produced in the state, which is similar in quality to diluted bitumen from the oil sands. Additionally, shipping to California would be approximately US$5/bbl which would be about half the cost of shipping crude oil to the US Gulf Coast [5].

The Trans Mountain pipeline system will also be able to supply overseas markets in the Asia-Pacific. Although the global oil demand forecasts note that advanced economies may never return to pre-COVID levels growth is still forecast in Asian markets. The IEA has noted that Asia will account for 90% of growth in global oil demand between 2019 and 2026 [13], with only half of this demand able to be met by the Middle East. Due to this the Asia-Pacific market demonstrates opportunities for crude oil markets beyond the US.

Conclusion

Based on this analysis, existing and under construction pipelines and expansions are necessary to allow for Western Canadian crude oil to reach existing refining markets and increase deliveries into markets with potential opportunities for further expansion. Additionally, increased utilization of existing assets through system optimizations and expansion projects can continue to increase the capacity of pipeline systems into potential markets and allow shippers flexibility as the North American pipeline system is debottlenecked. However, this will continue to be dependent on the production of crude oil being in-line with forecasted estimates which are subject to changes from market forces linked to crude oil prices and demand.

Notes

1 MMb/d is millions of barrels of crude oil per day

2 Mb/d is thousands of barrels of crude oil per day

References

[1]”2019 Crude Oil Forecast, Markets and Transportation”, Capp.ca, 2019. [Online]. Available: https://www.capp.ca/wp-content/uploads/2019/11/2019_Crude_Oil_Forecast_Markets_and_Transportation-338794.pdf. [Accessed: 05- Apr- 2021].

[2]”Oil Pipelines | Oil Sands Magazine”, Oil Sands Magazine, 2021. [Online]. Available: https://www.oilsandsmagazine.com/projects/crude-oil-liquids-pipelines. [Accessed: 05- Apr- 2021].

[3]TC Energy, “TC Energy disappointed with Expected Executive Action revoking Keystone XL Presidential Permit”, 2021.

[4]”Canada’s Energy Future 2020: Energy Supply and Demand Projects to 2050″, Cer-rec.gc.ca, 2020. [Online]. Available: https://www.cer-rec.gc.ca/en/data-analysis/canada-energy-future/2020/canada-energy-futures-2020.pdf. [Accessed: 28- Mar- 2021].

[5]”Ten reasons why Keystone XL doesn’t matter so much any more | Oil Sands Magazine”, Oil Sands Magazine, 2021. [Online]. Available: https://www.oilsandsmagazine.com/news/2021/1/23/ten-reasons-why-keystone-xl-doesnt-matter-so-much-any-more. [Accessed: 05- Apr- 2021].

[6]C. Varcoe, “Varcoe: New Canadian energy outlook an ‘inkblot test’ for pipeline views”, Calgary Herald, 2021.

[7]Natural Resources Canada, “Crude oil facts”, Nrcan.gc.ca, 2021. [Online]. Available: https://www.nrcan.gc.ca/science-data/data-analysis/energy-data-analysis/energy-facts/crude-oil-facts/20064. [Accessed: 05- Apr- 2021].

[8]Canadian Association of Petroleum Producers, Canadian and U.S. Crude Oil Pipelines and Refineries – 2020. 2020.

[9]”Assessing America’s Appetite for Canada’s Crude: A Look at Canadian Crude Usage by U.S. Refineries | Oil Sands Magazine”, Oil Sands Magazine, 2020. [Online]. Available: https://www.oilsandsmagazine.com/market-insights/american-appetite-canadian-crude-usage-us-refineries. [Accessed: 05- Apr- 2021].

[10]”Gulf Coast (PADD 3) Imports by PADD of Processing from Canada of Crude Oil (Thousand Barrels per Day)”, Eia.gov, 2021. [Online]. Available: https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MCRIPP3CA2&f=M. [Accessed: 05- Apr- 2021].

[11]G. Morgan, “How a pipeline replacement, expansion and reversal give oil producers new route to Texas”, Financial Post, 2021.

[12]”Market Access”, Enbridge.com, 2020. [Online]. Available: https://www.enbridge.com/reports/2020-liquids-pipelines-customer-handbook/market-access. [Accessed: 05- Apr- 2021].

[13]International Energy Agency, “Oil markets face uncertain future after rebound from historic Covid-19 shock”, 2021.